Are you looking for an investment strategy with these advantages?

Diversification

Commodity futures have a low

correlation to the stock market.

Increased Returns

Commodities in a portfolio with

stocks lowers overall risk and

increases expected returns.

Leverage

Tax Advantages

Futures trades are taxed using

the 60/40 rule where 60% is

treated as long term.

Ideal for Busy Schedules

Pre-determined optimal entry

and exit dates and extended

trading hours is ideal for

working professionals.

You have come to the right place!

TRADING FUTURES INVOLVES SUBSTANTIAL RISK OF LOSS AND IS NOT SUITABLE FOR ALL INVESTORS. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THERE ARE NO GUARANTEES OF PROFIT NO MATTER WHO IS MANAGING YOUR ACCOUNT.

Diversification

Commodities are real assets that have a low or negative relationship to stocks. Because commodities are real assets, they tend to react to changing conditions differently than stocks.

Increase in Oil Prices

Increase in Grain Prices

Decrease in Auto Sector Equity

Decrease in Food Manufacturing Equity

TRADING FUTURES INVOLVES SUBSTANTIAL RISK OF LOSS AND IS NOT SUITABLE FOR ALL INVESTORS. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THERE ARE NO GUARANTEES OF PROFIT NO MATTER WHO IS MANAGING YOUR ACCOUNT.

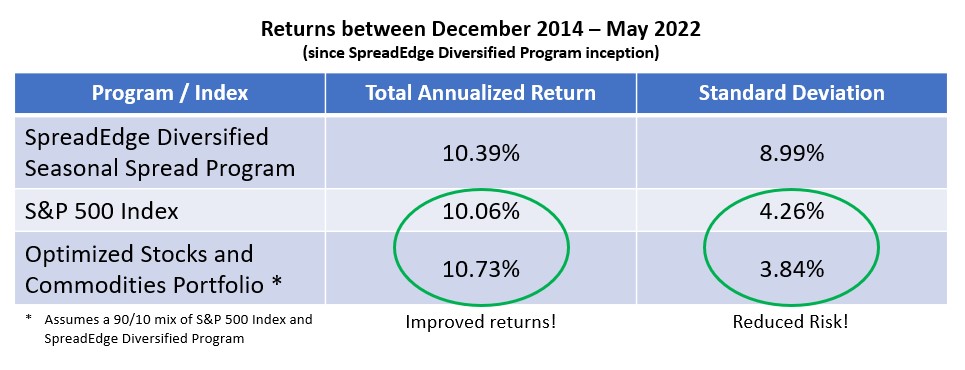

Increased Returns

By adding commodities to a portfolio of stocks, the overall risk of the total portfolio decreases. This is due to the low or negative correlation between commodities and stocks.

TRADING FUTURES INVOLVES SUBSTANTIAL RISK OF LOSS AND IS NOT SUITABLE FOR ALL INVESTORS. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THERE ARE NO GUARANTEES OF PROFIT NO MATTER WHO IS MANAGING YOUR ACCOUNT.

Leverage

Leverage is the ability to control a large contract value with a relatively small amount of capital. In the futures market it is called margin and is typically 3-12% of the contracts cash value. Leverage magnifies both profits and losses so proper risk management is an important element.

Let’s say you have $9,000 and want to own Gold

Physical Gold

• Cost is $1,800 / oz

• Can buy 5 oz

• Cash value = $9,000

Gold Stock ETF

• Cost is $9,000 • 50% Margin • Cash value = $18,000

Gold Futures

• Margin is $4,500 / contract • Can buy 2 contracts • Cash value = $360,000TRADING FUTURES INVOLVES SUBSTANTIAL RISK OF LOSS AND IS NOT SUITABLE FOR ALL INVESTORS. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THERE ARE NO GUARANTEES OF PROFIT NO MATTER WHO IS MANAGING YOUR ACCOUNT.

Tax Advantages

Futures can provide a significant tax benefit compared to other short-term trading markets. That’s because profitable futures trades are taxed on a 60/40 basis: 60% of profits are taxed as long-term capital gains and 40% as ordinary income.

Compare that to stock trading where profits on stocks held less than a year are taxed 100% as ordinary income.

TRADING FUTURES INVOLVES SUBSTANTIAL RISK OF LOSS AND IS NOT SUITABLE FOR ALL INVESTORS. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THERE ARE NO GUARANTEES OF PROFIT NO MATTER WHO IS MANAGING YOUR ACCOUNT.

Ideal for Busy Professionals

Futures markets have extended hours, so trading works around any schedule.

Trading decisions are based on end of day closing prices so there is no need to closely watch the market intra-day.

TRADING FUTURES INVOLVES SUBSTANTIAL RISK OF LOSS AND IS NOT SUITABLE FOR ALL INVESTORS. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THERE ARE NO GUARANTEES OF PROFIT NO MATTER WHO IS MANAGING YOUR ACCOUNT.